Any payments by Traders Union () to the users of our website shall be legally interpreted solely as an incentive on our part for the activity on the website in the form of a deduction of a part of the advertising income they shall not be a subject of any claims of our users or our obligations, a subject of disputes, as well as cannot be considered in relation to the services provided to users by brokers, both in fact and in their completeness and volume. The information on this website is not intended for distribution or use by any person in any country or jurisdiction, where such distribution or use would be in violation of the local law or regulation. Before investing money, you need to adequately assess the level of your expertise and be aware of the risks, particularly in the context of trading with leverage.

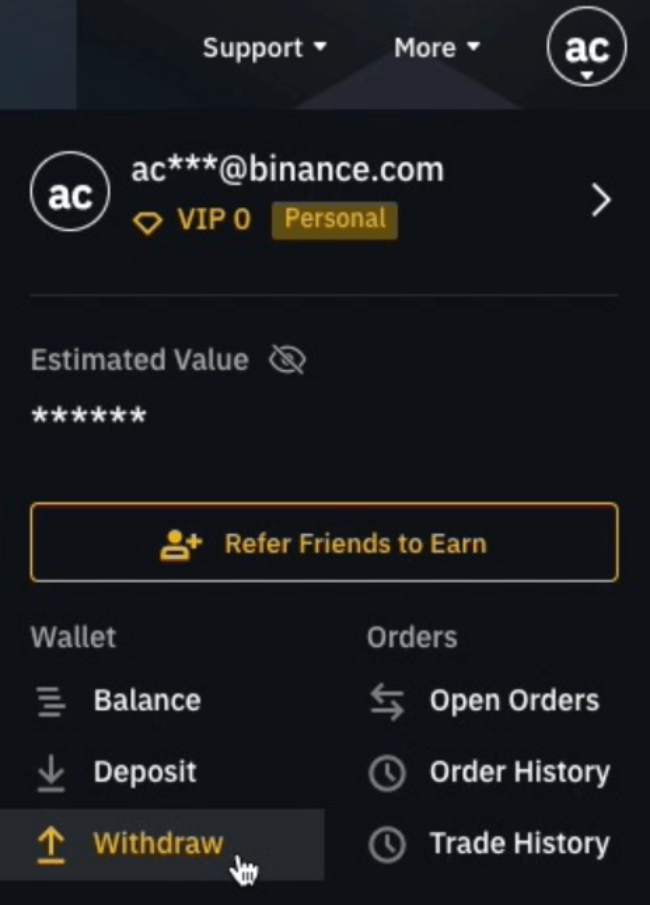

Forex market, CFD and cryptocurrency trading involves high risks and is not suitable for everyone. Traders Union () shall not be liable for the consequences of trading decisions made by the Client and for the possible loss of his capital resulting from the use of this website and information published on it. The fees are specified in the comparative table below:įunding fee (individual for each contract)įunding fees are paid to the base fund based on the funding rateĬomparative analysis shows that Bybit fees are more attractive. They represent a basket of contracts for the underlying asset. Leveraged tokens are derivatives with no margin or liquidation risks. Meanwhile, the interest rate charged by Binance on XRP is higher: 0.03% and 11.15% respectively. The exchange also charges a 2% fee for margin position liquidation.įor comparison: the interest rate charged by Binance on BTC is much lower: 0.04% daily, and 1.81% annual. The table below provides examples of interest rates for certain cryptocurrencies: The interest rate on the loan has two calculation formulas: daily rate and annual rate. The Real-Time Exchange Rate is based on the best quote price from several market makers according to the current index price.īybit offers leverage for cryptocurrency trading that allows you to use assets in your Spot Account as collateral to borrow additional funds from Bybit in order to open positions larger than your wallet balance. Bibit offers three types of USDC-settled options: BTC options, ETH options, and SOL options. The taker and maker fees are calculated in the same way as in spot trading.Ĭryptocurrency options give the right (but not an obligation) to buy or sell underlying cryptocurrency at the predetermined price upon expiry of the contract or prior to its expiry. The table below shows the trading fee you’ll be charged when you trade spot markets on Bybit.Ī futures contract is an agreement between parties to sell or buy cryptocurrency on a specified date, and at a predetermined price. ≥ 500M and 0.25% of the total trading volumeĪt least 0.5% of the total trading volume (with trading volume via API not more than 20%) Table of assignment of VIP levels depending on the trading volume: Levelģ0-day trading volume (USD), including leverage The VIP status of a user depends on the asset balance, BIT balance, borrowed amount and 30-day trading volume.

For example, starting with the Supreme VIP level, maker fee for futures trading is zero. Upon fulfillment of trading volume requirements, the user’s status gets upgraded, and the taker and maker fees decrease with each new level. Following registration, a user is assigned a Non-VIP status, the initial level. The Bybit fee schedule comprises 10 user levels. It is deducted from the wallet balance and won’t affect the initial margin of the order. The trading fee is incurred upon execution of an order. Trading Fee = Filled Order Quantity x Trading Fee Rate.īybit may charge a trading fee when an order is executed.

0 kommentar(er)

0 kommentar(er)